Purpose-built for payments-enabled companies

Our platform is configurable to support your business model so you can build a standout financial experience and become the best-in-class financial partner for your customers.

Step 1: Enable multi-product adoption from day one

Our core infrastructure makes it effortless to launch one financial product or a suite of financial products—all with near-instant enrollment. Increase your customer lifetime value and deepen customer relationships with zero added complexity.

Merchant Onboarding

The gateway to your unified financial ecosystem

We provide a way to easily onboard new merchants.

White-labeled onboarding forms with multi-product support

Configurable underwriting engine to provide seamless KYB/KYC and bank verifications

Streamlined case management, flexible error handling, and automated decisioning

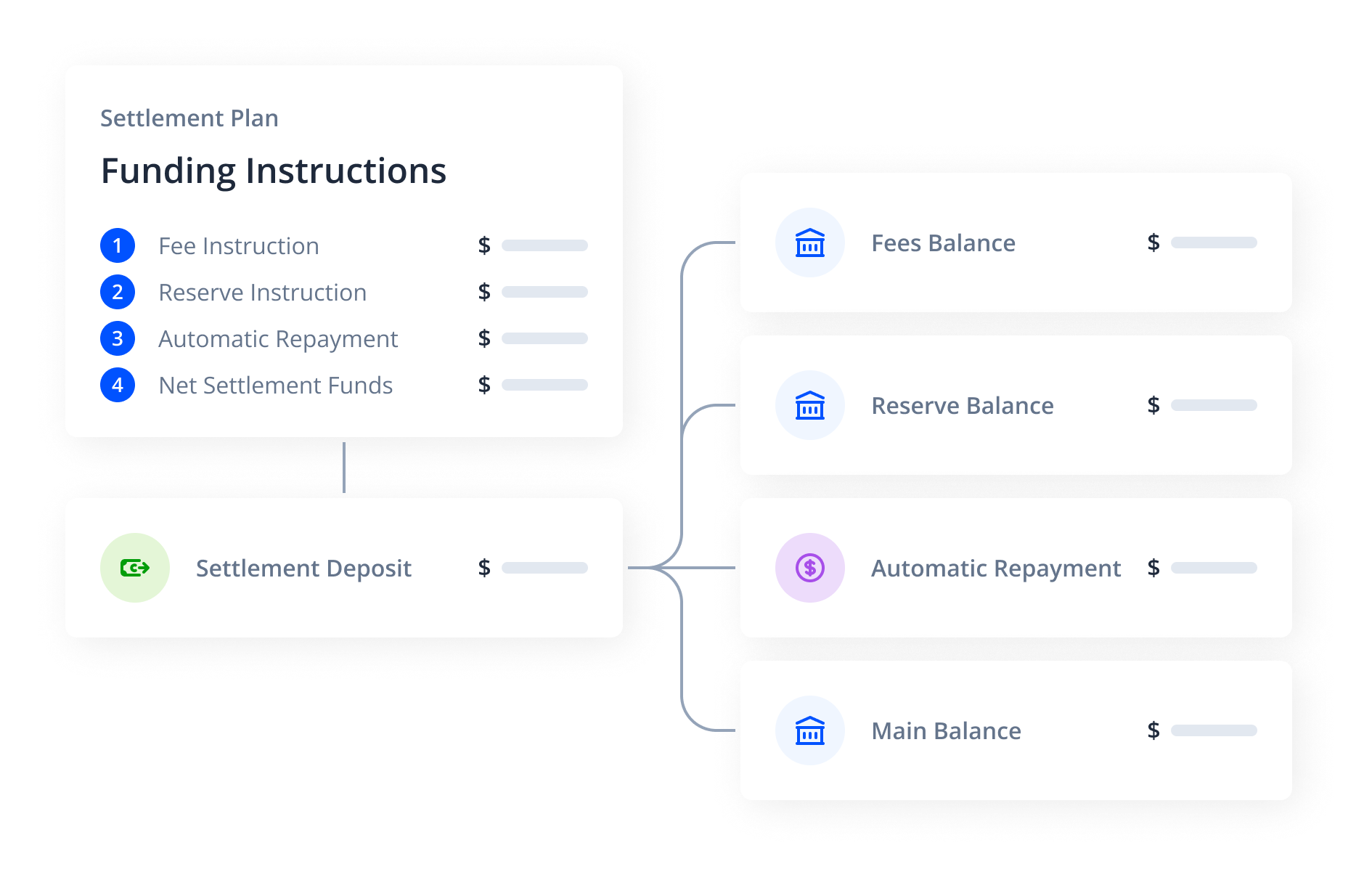

Jaris Managed Settlements

The financial backbone for growth, reliability, and scalability

View and control dynamic funding instructions across any processor.

Automatically-created Jaris bank accounts to receive settled funds

Standardized funding flows to collect fees, reserves, and repayments

Real-time disbursement tracking for all deposits from a single dashboard

Test

We are a team first

Teamwork is what gets us across the finish line. We succeed together and push each other to raise the bar.

We own it

We take responsibility for outcomes, follow through on commitments, and do what it takes to deliver.

We are mentally tough

We embrace challenges, have open and honest communication, and maintain our drive during hard times.

We start and end with quality

Excellence is non-negotiable. We take pride in our craft and focus on the details that drive quality.

We know our numbers

We track what matters, make smart decisions based on data, and use insights to drive action.

We do our jobs first

We execute our responsibilities with excellence because our teammates depend on us.

News

Access expert insights, success stories, and valuable resources from embedded finance experts. Our platform is configurable to support your business model so you can build a standout financial experience and become the best-in-class financial partner for your customers.

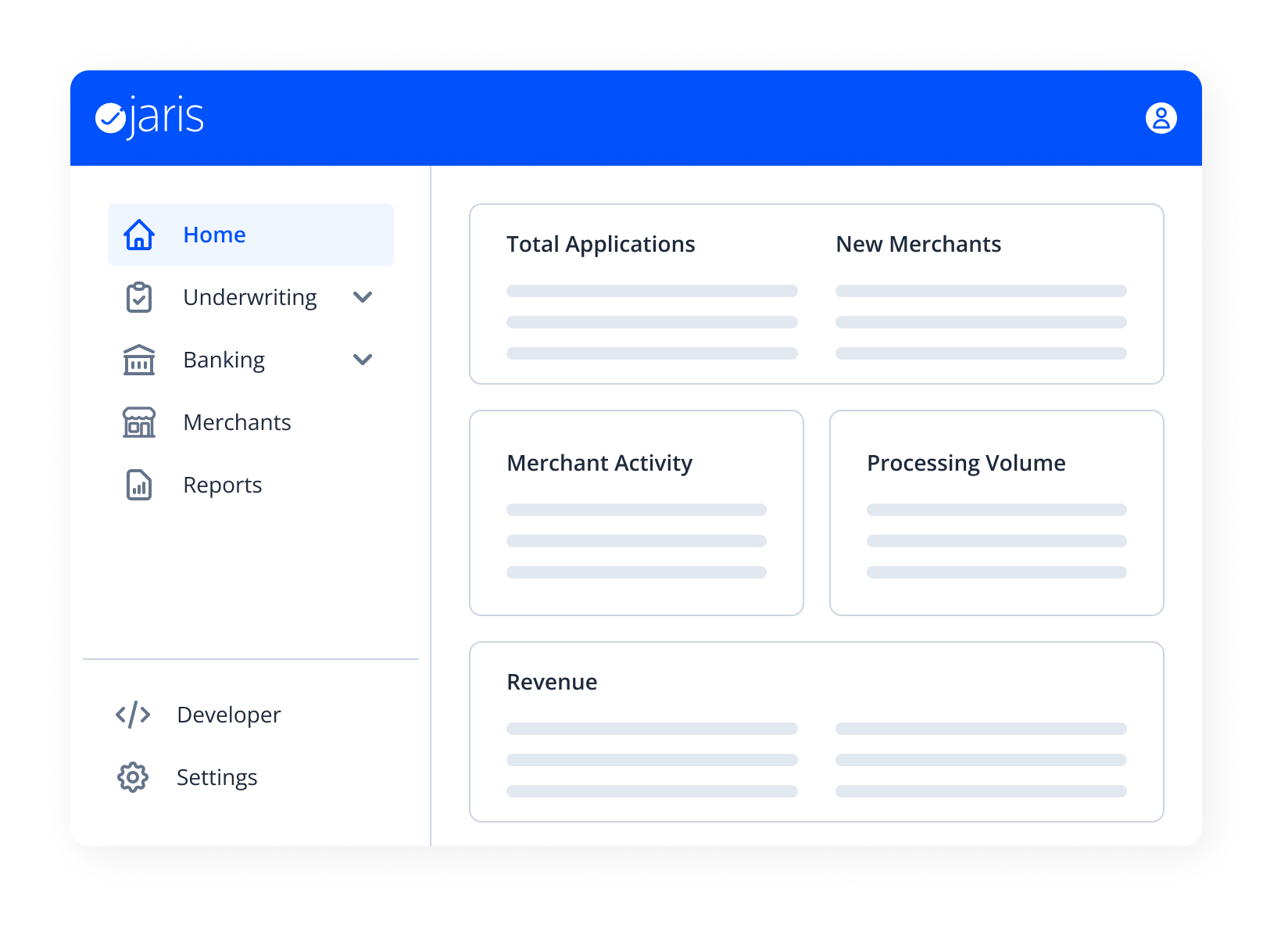

A first-of-its-kind platform

Legacy payment processors and providers offer fragmented solutions that do not work together. With a single integration, Jaris provides a modern banking infrastructure to help you launch financial products, unlock new revenue streams, and empower your customers.

Merchant Onboarding

One application for all products, seamless KYB/KYC, automated underwriting, and instant creation of Jaris bank accounts for merchants.

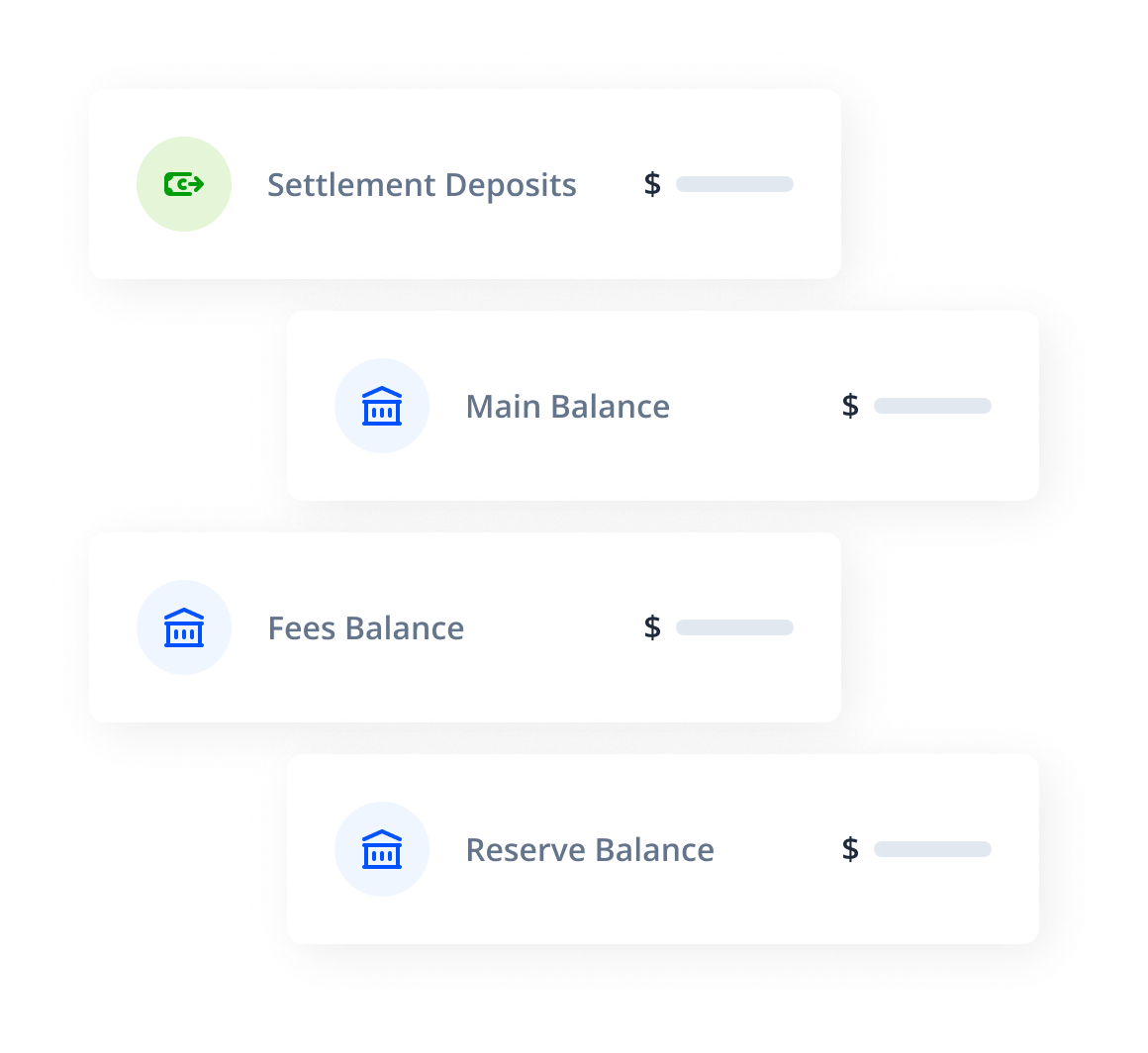

Jaris Managed Settlements

Flexible money movement from any processor to Jaris bank accounts with real-time settlement control collect fees, manage reserves, and more.

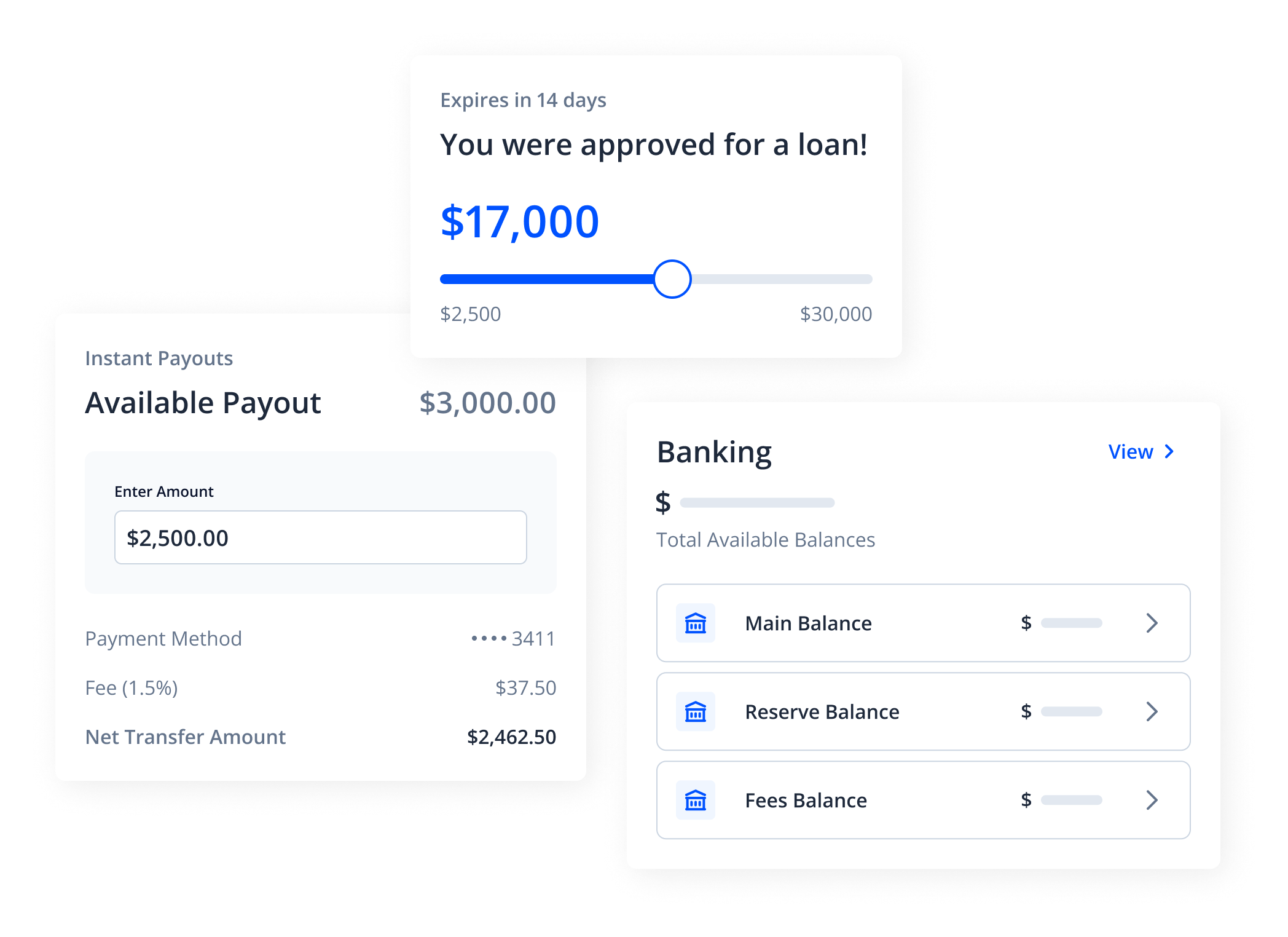

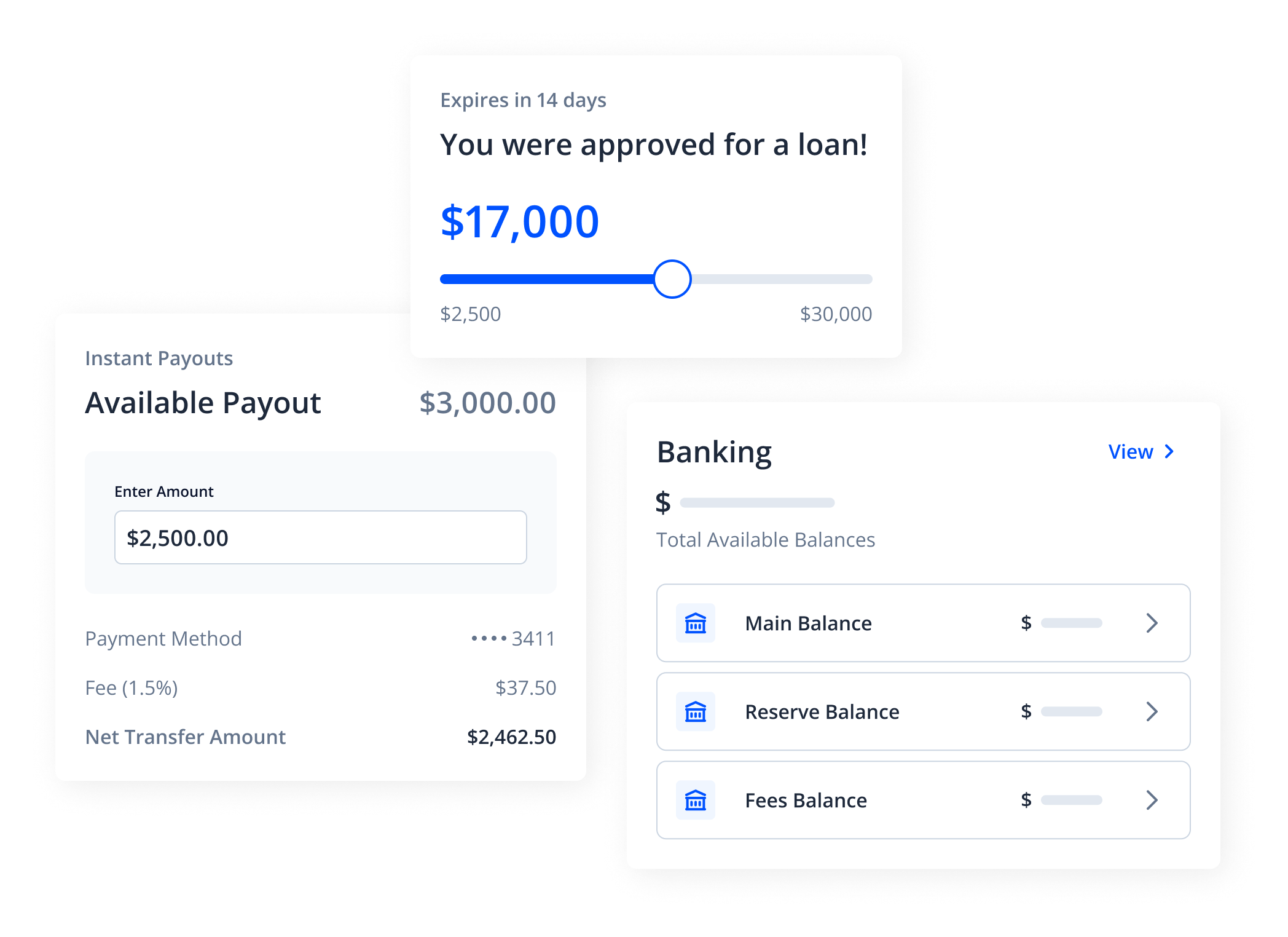

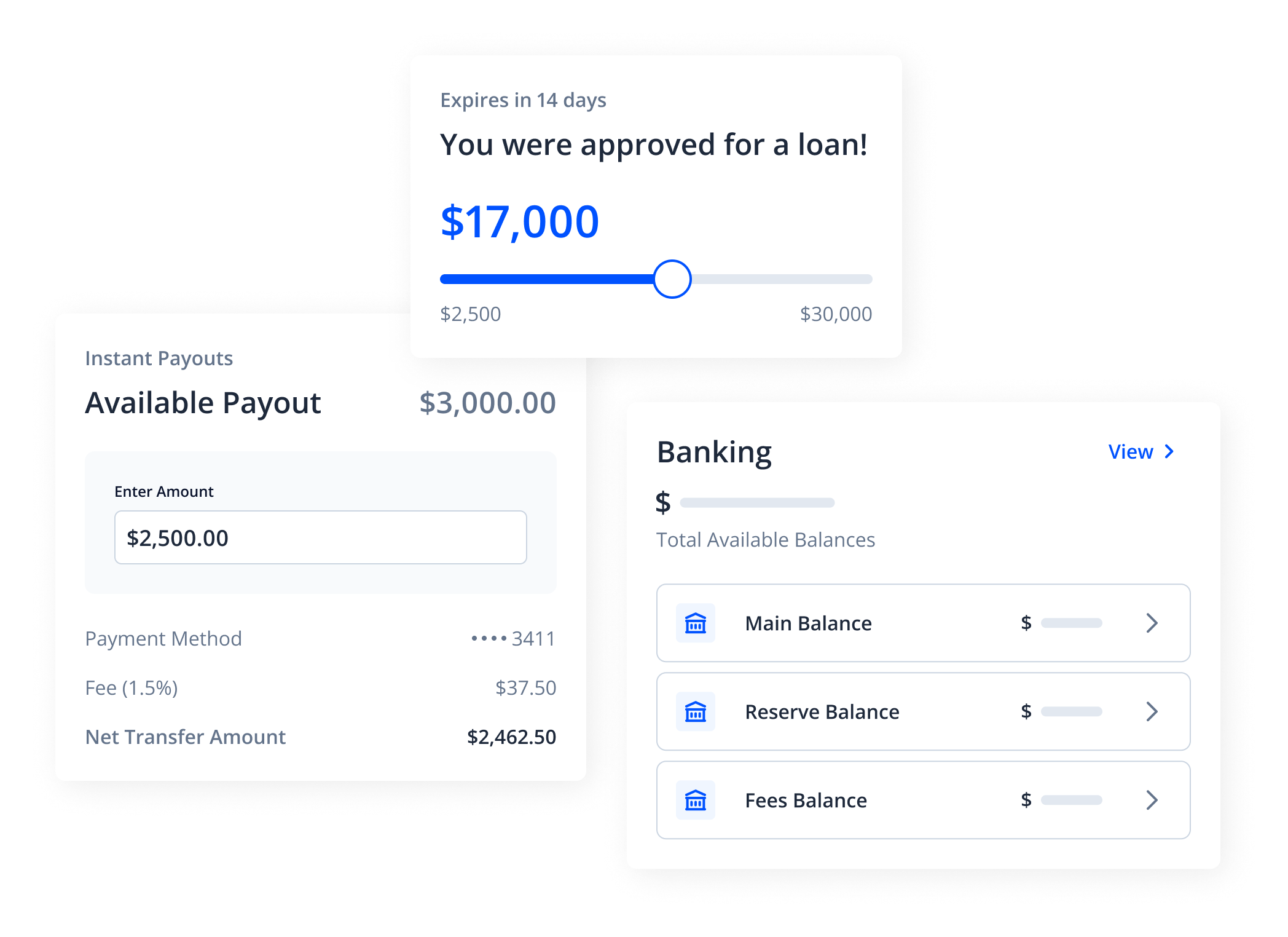

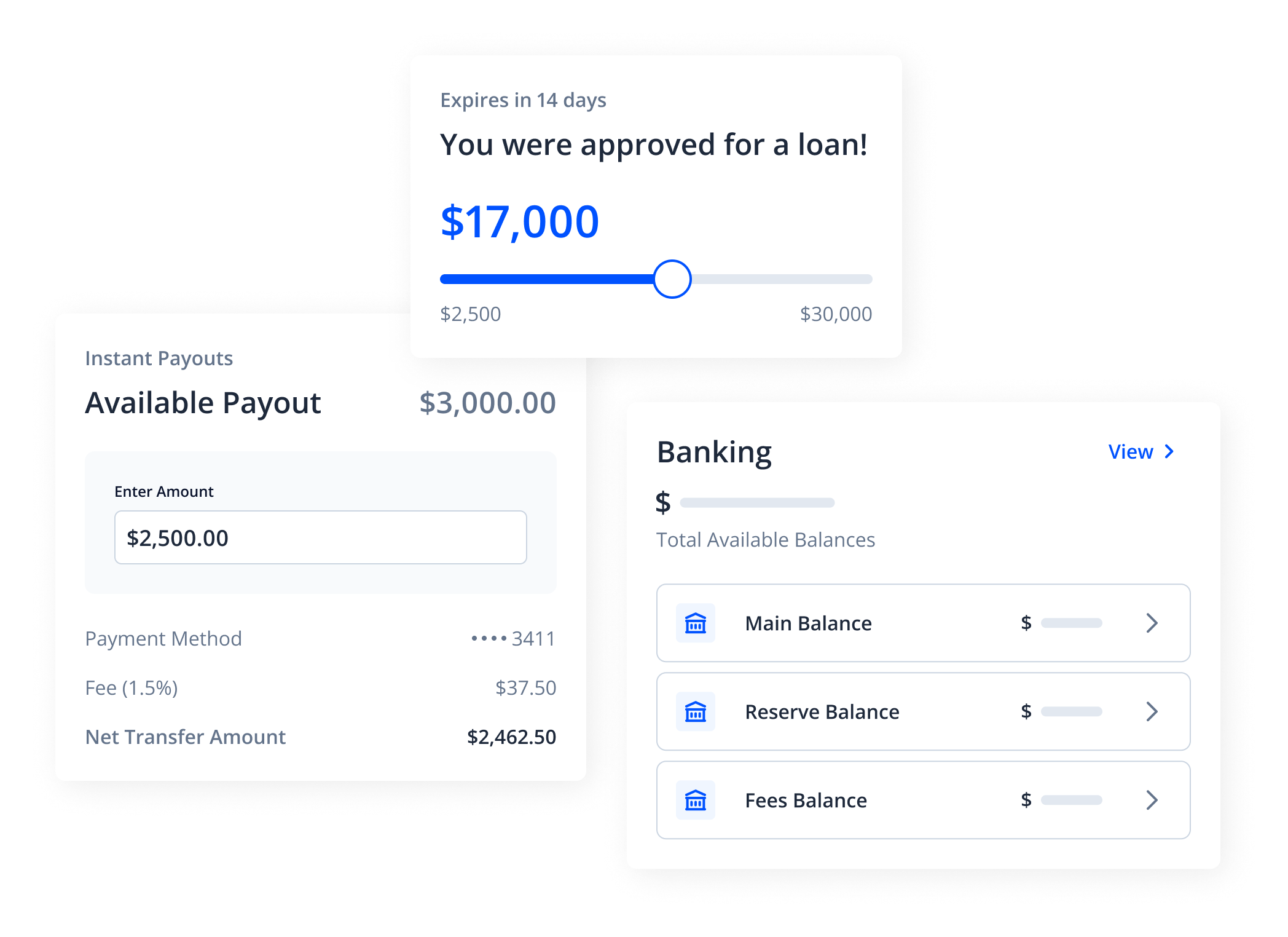

Business Loans

Affordable capital and same-day funding to help your customers grow their business.

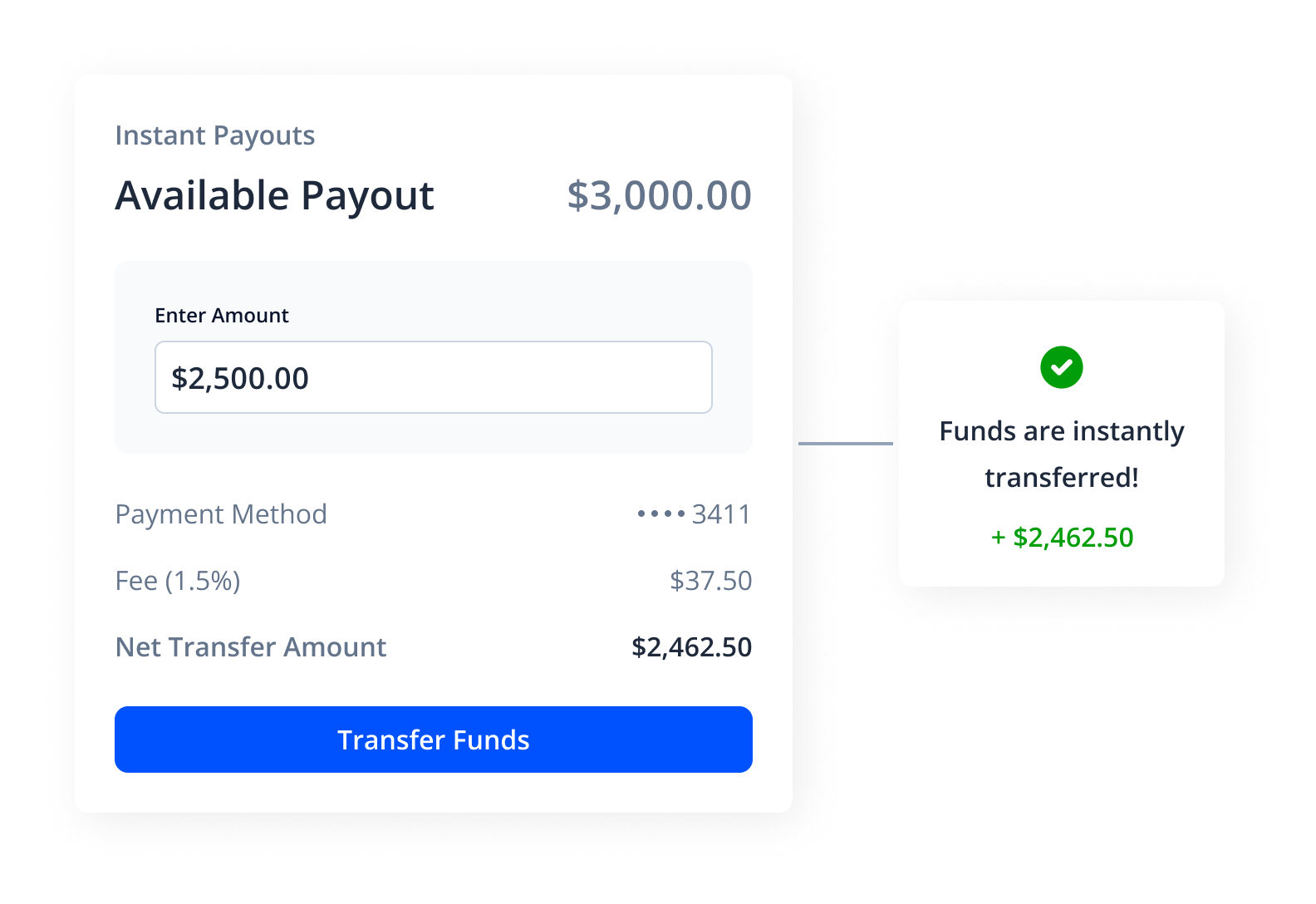

Instant Payouts

Early access to earned revenue with instant funding when your customers need it most.

Business Banking

Commercial banking suite for you and your customers.

Flexible implementation to fit your roadmap

With multiple paths for implementation, you will be up and running in weeks instead of months.

Jaris Connect

Embed our pre-built UI with your brand and let customers access financial products without ever leaving your platform.

Learn more

Merchant Dashboard

Put merchants in control with a branded portal to view pre-offers, manage payments, and handle finances on their own.

Custom API

Build a fully customizable API-based integration and control the entire experience for your customers.

3:1

3 Products, 1 integration

40%

Higher customer retention

2x

Customer lifetime value

$1B+

Capital deployed

< 4%

Loss rates

50 states

Licensed and operating

5+ years

Bank program manager

3 products, 1 integration

Launch in weeks, not months, to open up new revenue streams

Increase engagement

Partners who embed our products see higher customer retention

2x customer LTV

Multi-product adoption multiplies the revenue opportunity