How Mohsen Corporations uses Capital Connect to compete in a volatile market

For Susana and Mohsen, founders of Mohsen Corporations, timing is everything. Operating a trucking fleet and a network of gas stations since 1995, they face a unique challenge: fuel price volatility. In a market where prices change by the second, having capital available at the right moment is the difference between profit and loss.

The challenge: Buying power in a fast-moving market

"Gas is like the stock market—prices change every second," explains Mohsen. "We needed additional capital to give us the firepower to buy fuel when prices dip."

Because they both sell fuel to retail customers and buy it to power their own trucks, they feel price swings from two angles. Missing a brief window when prices drop means leaving significant profit on the table. When fuel prices dip, they need to act immediately—but traditional financing often takes too long.

The solution: Capital Connect, powered by Jaris

Susana reached out to her payment processor, PCS (part of Paysafe), to discuss her needs. Through the Capital Connect program—a partnership between Paysafe and Jaris—Susana found the Flex Loan solution her business required.

“We needed access to capital so we reached out to PCS and they connected us with Jaris. The process was simple – we applied online, got approved and had access to cash in days.” — Susana, Mohsen Corporations

How it works

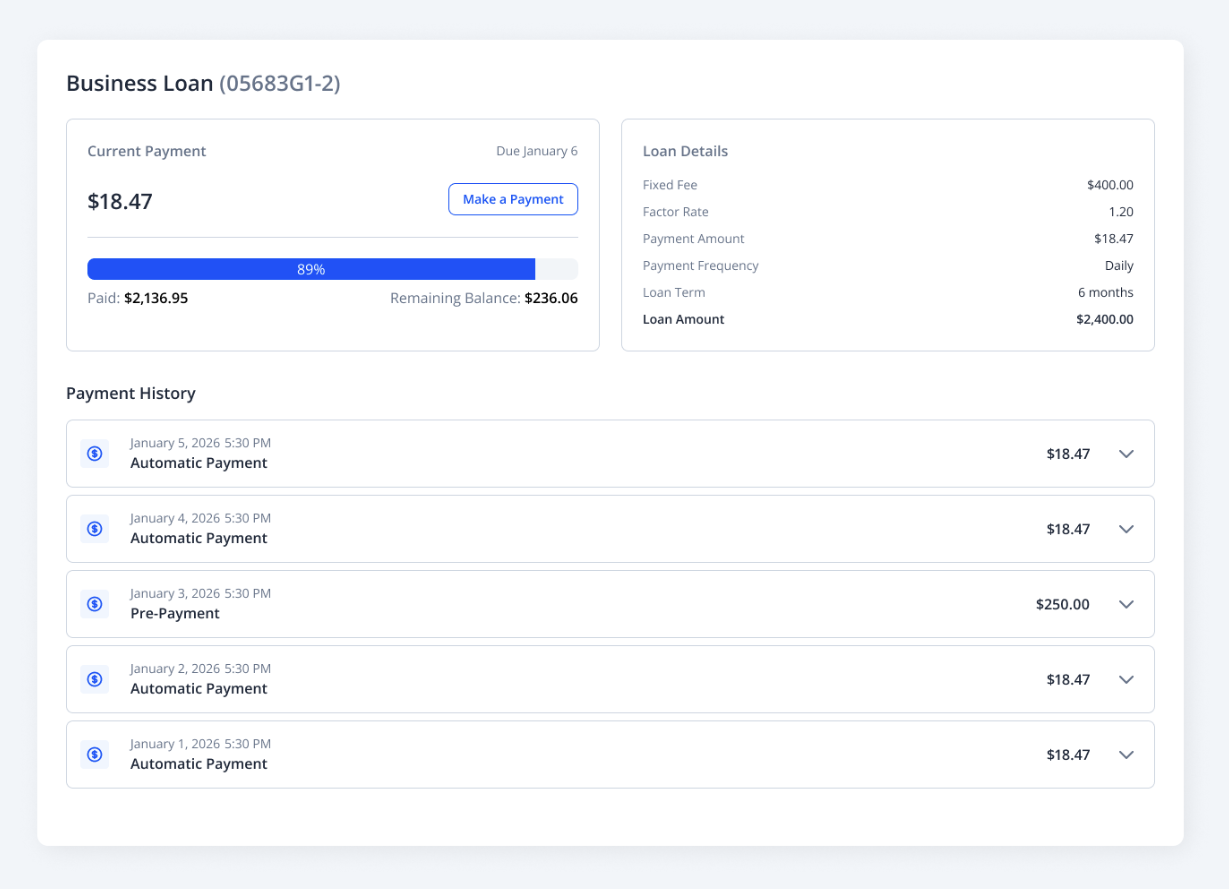

Capital Connect offers Flex Loans designed specifically for small business needs:

Apply in minutes for a same-day decision

Access tailored offers based on your card sales

Automate repayments through your daily revenue

Review transparent fixed fees with no paperwork required

For Mohsen Corporations, the automatic repayment feature was key—payments scale with revenue, so they never face a cash crunch during slower periods.

The impact: Growth and confidence

The additional capital gave Mohsen Corporations the strategic buying power to purchase inventory at optimal prices and maintain healthy margins. This success has given them the confidence to plan for the acquisition of more gas stations.

Beyond the capital, Susana credits the partnership for their continued success.

“The overall support with Jaris has been excellent. We plan to continue leveraging Capital Connect to support our business growth.” — Susana, Mohsen Corporations

About Capital Connect

Paysafe has partnered with Jaris, an embedded finance leader, to power Capital Connect. This program offers seamless access to financial products such as Flex Loans and Instant Payouts to help small businesses grow.

About Jaris

$1B+ financing capacity, hundreds of millions funded

Licensed in all 50 states through partner banks

Enterprise-grade PCI and SOC 2 security

For payment companies looking to launch financial products for small businesses, contact us to learn more.