Launch a full financial ecosystem in weeks

Purpose-built infrastructure that lets you create, launch, and scale financial products fast.

Power your platform with a complete set of financial products

Onboard and underwrite merchants in minutes, create bank accounts, manage settlement flows, offer loans, instant payouts, and more, in one place.

A first-of-its-kind infrastructure sets the foundation

Infrastructure layers:

Onboarding

The gateway to your financial ecosystem. Increase conversion with pre-populated applications, real-time data validation, and multi-product enrollment.

6 min average application time

Automated error handling with corrections in hours, not days

Near-instant enablement of future products

Managed settlements

Orchestrate dynamic settlements across any processor. Control money movement and risk management with standardized funding flows.

Automatically collect fees and reserves

Manage settlements across multiple backend processors

Gain real-time visibility of disbursements activity across your portfolio

For near-instant enablement of revenue-generating products

Instant payouts

Provide early access to earned revenue with instant funding up to $10K of current day’s sales. Available whenever your merchants need it most.

Fund up to 90% of daily card sales in seconds

Help merchants meet payroll and other near-term cash flow needs

Schedule payouts for future non-bank day, such as holidays

Loans

Give your customers fuel to grow with easy, affordable access to capital. Offer multiple loan products with simplified pricing and automated payments.

Personalized loan offers for eligible merchants

Flex loans and installment loan options

Same-day approval, funding, and settlement

Banking services

Offer comprehensive commercial banking suite. Commercial DDAs, high-yield savings accounts, and more integrated seamlessly with payment processing.

Help merchants store and manage their money

Create stickier deposit relationships

Earn banking service revenue

Maximize adoption with our hybrid launch strategy

Deliver a streamlined application process for existing merchants, and effortless enrollment for future customers by adding Jaris to your payment onboarding experience.

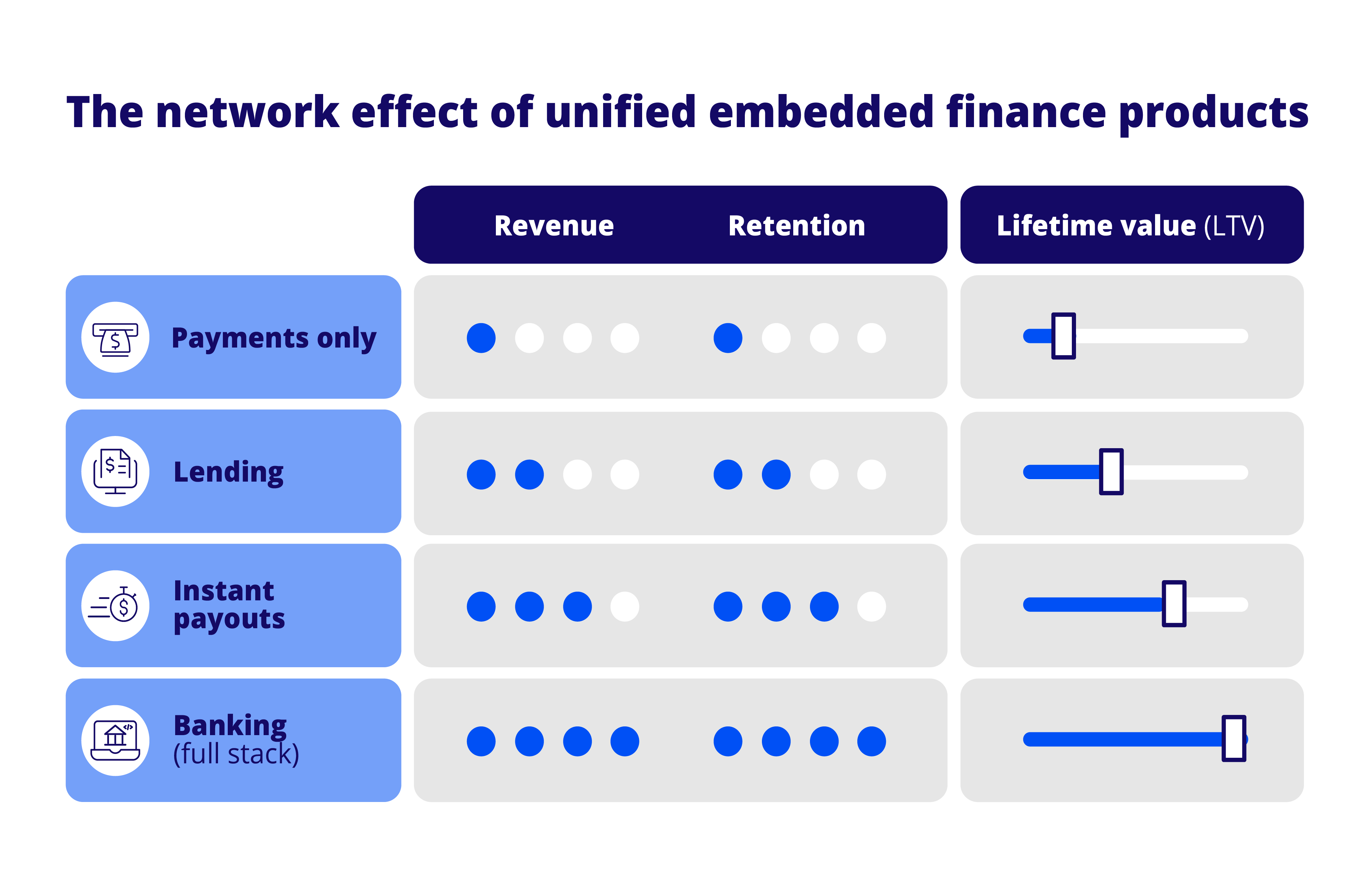

From payment provider to complete financial partnership

Jaris gives you a unified growth engine where every product reinforces and multiples the impact of the next.

Flexible frontend & integration options

Embed finance your way — hosted, embedded, or fully white-labeled.

Deliver finance experiences that match your brand.

Hosted or co-branded flows

Onboarding, lending, instant payouts, and banking

Merchant-facing dashboard

Turnkey lifecycle enablement

Jaris manages the heavy lifting to support you and your merchants throughout the customer journey.

Tailored engagement

White-labeled awareness and nurturing emails

Increases conversion by 15-20%

Expert servicing

Jaris manages all servicing and collection activities

US-based support teams handle all merchant inquires

Dedicated support

Implementation manager and 1:1 training sessions

Ongoing sales support whenever you need it

"Integration took just three weeks, and our merchants immediately started adopting multiple products. The Jaris team made everything seamless."

Andrea Kando

Chief Payments & Strategy Officer

Turn your payments business into a growth engine

Help your merchants succeed while you build new revenue streams and deeper relationships.